Trust First Pricing Principles

By Maggie Patterson

All opinions in this post are my opinions and mine alone.

Listen Now To This Essay On The BS-Free Service Business Show

If you run a business, there’s no escaping the need to price your offers. But when it comes to pricing there are so many ways to do it, so many strategies….and so much advice, that it can be incredibly complicated to navigate.

Especially if you’re committed to running your business in a way that’s not buying into the BS of online business. In this episode, we’re digging into common pricing tactics in the online business world, and their alternatives.

The High Ticket Everything Problem

Now, back to the pricing bubble I alluded to a moment ago. It’s been brewing for years, but we’ve now reached a point of “high ticket” everything.

From one-day events with a five figure price tag to day rates that are $5k or more, pricing has nothing to do with experience or value, but instead status and acquiring wealth.

For consumers in this market, it’s become a badge of honor that you invest that type of money in your business. Dr. Peter Noel Murray, a specialist in the psychological drivers of consumer behavior, shares how luxury purchases are often motivated by our sense of identity and how they make us feel.

The businesses charging these prices use a wide variety of sales strategies in order to convince you that you’re “worth” it. They do this even if they know that there’s no ostensible way you’ll get any return on that investment, because they have a singular goal, which is to make the sale no matter what.

That’s not to say all high ticket pricing is evil, as there are times where I do believe it’s warranted. (But not nearly as much as this industry and its current high ticket everything extravaganza would lead one to believe.)

Too many times with high ticket pricing, sellers get richer, while buyers get totally screwed over. It may seem cynical, but that’s the experience I’ve seen over and over again, and truthfully, high ticket everything is having such a moment that we’re being lulled into believing this is the only way to do business.

I have a lot more to say about the power dynamics of high ticket pricing and its many problems, but in the context of this essay and podcast episode, this is just one of the predatory pricing strategies at work today in online business.

Here are a few others at play in the online business world right now.

One of the most pervasive tactics when it comes to pricing in the online business world is the fact that the price is not easily accessible. Prices are hidden in many ways.

Sometimes you’re required to fill out an application to learn how much the program or mastermind costs. In other situations, you need to get on a sales call, or watch a webinar to learn more.

Hidden pricing is built on the belief that consumers need to to be coached in order to make the sale, and that if they see the price they’ll immediately object. The goal is to get the potential customer to make a series of micro commitments to show “they’re serious” about the opportunity. As the potential customer makes these commitments, either by filling out an application or sitting through a sales call, they’ve now invested time in the process.

This is where sunk cost fallacy kicks in. Once that time or energy (or even money if there’s a deposit for the application) has been invested, they’re more likely to complete the purchase.

While there may be exceptions (like with customized pricing for services) where a price can’t be easily shared, that’s not the case for courses, programs and masterminds as they have a fixed price.

Where there’s a fixed price for an offer, gating the price from potential customers should be viewed as questionable at best. Making people get into the sales process to get basic pricing information is a red flag as it infantilizes the buyer and chips away at their agency.

In this situation, the seller is acting as a gatekeeper, making the potential for further manipulation (such as badgering the potential buyer into a yes on a sales call) that much higher.

Payment Plans

As an industry, online business has been built on payment plans. On one hand, they make larger investments much easier to cash flow, but many time payment plans are used in a predatory and deceitful way.

Payment plans are often subject to a “ finance” charge, which may sound reasonable on the surface. After all, there is a small cost related to the administration and processing of payment plans.

But if you look closely at payment plans, you’ll notice that in many cases, these payment plans include a charge of 20% or more. This is not a payment plan, it’s a poor tax that punishes people for not paying in full.

The upcharge for using the payment plan is designed to generate additional revenue. Why? Many of these programs and courses have high default rates as they encourage people to spend money they don’t have. The additional funds generated from payment plans helps offset the losses from defaulted payments.

The other common issue with payment plans is the use of the “extended” payment plans in order to get payments down to a price point that’s manageable for potential customers. While these payments are often pitched as an “accessible” option, they’re structured in such a way that you’re making payments far beyond the life of the program or course.

The extended payment plan has nothing to do with being accessible, and everything to do with doing whatever it takes to make the sale. They’re often introduced at the very end of a launch in order to get people off the fence.

This strategy relies heavily on what’s called price anchoring where we use the first mention of price to guide the decision. If you’re considering joining a course with a $497 monthly payment, then a new option is added where the payment is $297/month, it seems like a bargain, even if you ultimately end up paying more.

The Ethics of Pricing

Before we look at how we do better, I want to touch on the ethics of pricing, as it would be easy to quickly look at each of the tactics I’ve outlined above and label them as unethical.

The truth is there’s much more nuance required in a conversation about pricing strategies and tactics. Nothing I’ve shared above is illegal and isn’t really subject to consumer protection.

While the grocery store or gas station can’t engage in certain tactics such as price fixing, the cross border, digital nature of online business means regulation is non-existent.

Just because something isn’t illegal, doesn’t mean it’s right. How and when you use these tactics comes down to your personal and business ethics.

For me, none of these tactics are aligned with my business values, or my personal approach to business which is rooted in putting trust first. My goal with this discussion is not to be prescriptive in terms of what is and isn’t ethical, but to get you thinking about what’s right for you.

As my friend Michelle Mazur always reminds me, ethics are personal, and I firmly believe that it’s more impactful for you, as a business owner and consumer, to engage in critical thinking about pricing and decide for yourself.

Why Trust Matters

in Pricing

In early 2021, I conducted a survey of online business owners, examining spending habits and results. When looking at the most expensive investments made, trust was cited as one of the top three reasons people made those purchases. (The others being wanting to grow and community/peer support.)

This research is backed up by a 2021 report from Deloitte Digital called Trust Drives Profitable Pricing. While the study looks at the consumer, travel and hospitality industry, it provides valuable insights into the connection between trust and pricing.

“Trust is the foundation of the human experience; it is impossible to build successful relationships without it.”

The Deloitte Digital survey of over 100, 000 people found that “62% of customers buy almost exclusively from trusted brands and 88% of customers who highly trust a brand have bought from the brand again.”

The data is clear: trust increases the willingness to pay. In the context of online business, this a double-edged sword, as those engaging in questionable pricing practices are very aware of the need to create trust quickly with consumers.

In fact, that’s why many of these pricing tactics exist. They’re designed to swindle us into the sale quickly, and short circuit us into trusting them. These predatory pricing strategies are designed to strip away your self-trust so you’ll say yes.

The greater awareness we have of how trust is being weaponized against us, the smarter consumers we can be. We’ll have the critical thinking skills required to assess these pricing tactics before we buy, and see them for what they really are.

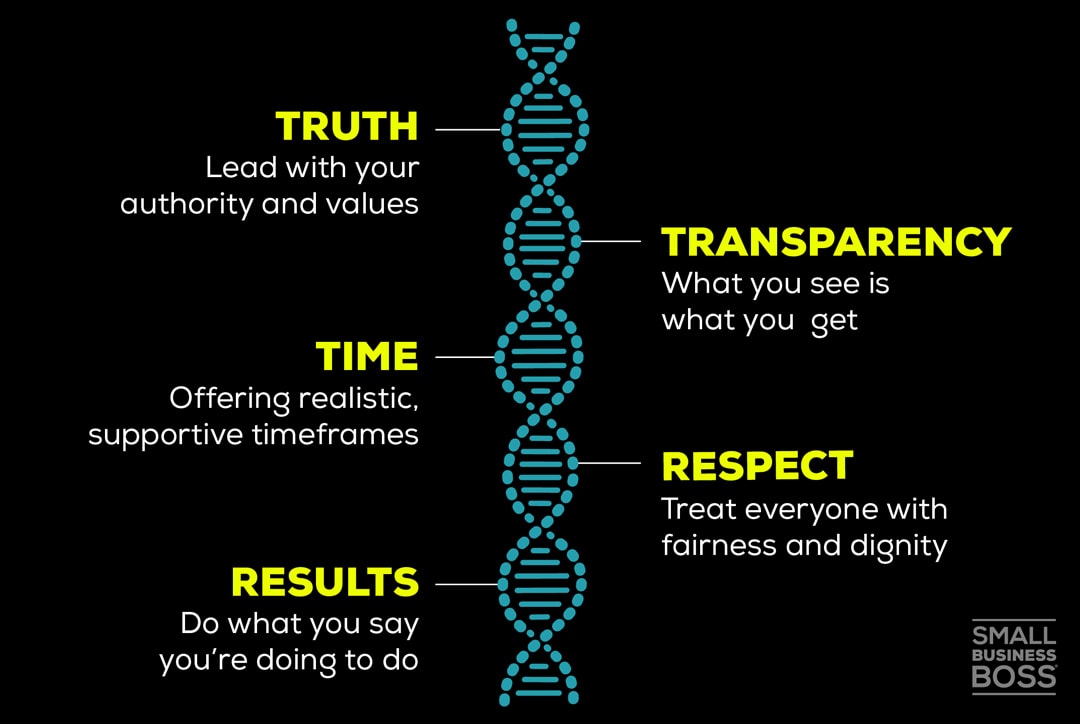

As business owners, we need a new path forward when it comes to building a business based on trust, and how we approach pricing. It’s not about us being able to charge more, but operating in a climate where we prioritize what I call the five trust cores — truth, transparency, time, respect and results — in our business relationships.

Most of all, taking a trust-first approach is a proven, BS-free way for us to build simple and sustainable businesses.

Now, let’s talk about the trust-first pricing principles.

How Will You Put Trust First in Your Pricing?

The Trust First Pricing principles I’ve shared in this episode and essay are designed to be both thought provoking, and to encourage you into taking action. Within this industry we all have the opportunity to shift how we price our services, and to skip the shifty tactics in favor of ones that build trust.

Which principle will you put into play first? The choice is yours.

Check out Profitable Pricing which includes a pricing calculator to help you nail down your pricing.