Getting

Your Salary

Paid First

By Maggie Patterson

All opinions in this post are my opinions and mine alone.

Too many solo business owners are underpaid (or not paid at all) as they fall into the trap of overinvesting in the business or pricing their services too low. And I’m not here for it.

In this episode, we’re looking at the nuts and bolts of paying yourself a salary as a solo business owner as part of our Staying Solo series.

Listen Now To This Essay On The BS-Free Service Business Show

The Impact of Expense Creep

We don’t talk nearly enough about expense creep on our bottom line and our feelings about our business and day-to-day life.

When you’re paying everyone else but not bringing home enough money on an ongoing basis, it’s a one-way ticket to resentment and business burnout.

Online business is deeply rooted in the idea that you must constantly “invest” in your business, and it’s normalized to spend money on tools, programs, and coaches when you’d be better served paying yourself.

That may seem overly simplistic, but there’s far too much emphasis on the capitalist mantra of “you need to spend money to make money.” That message gets tied up with our desire to live a comfortable, joyful life and then baits us into consistently spending money to chase that dream.

The irony is that, in many cases, the dream is within reach if we would only stop and recognize that we’re funding other people’s lives and often getting very little in return.

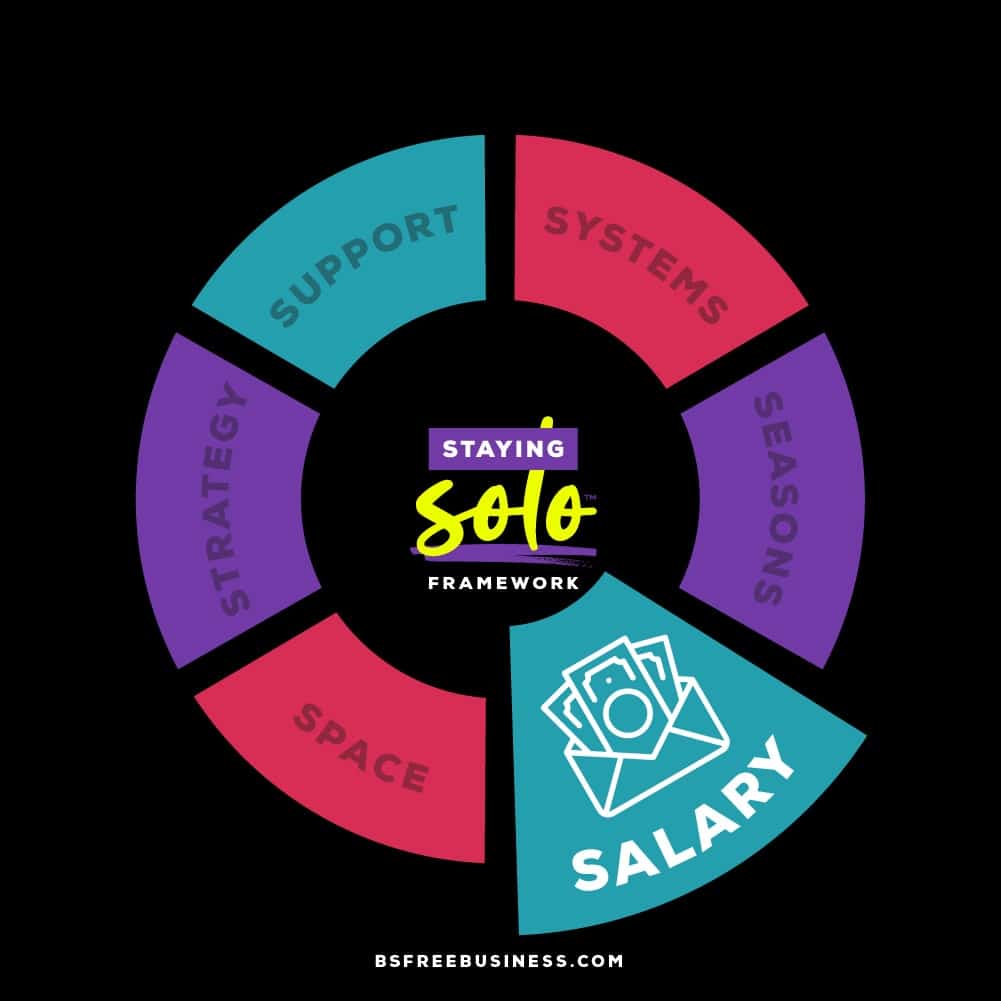

This is why salary is a cornerstone of Staying Solo, as for you to thrive, you need to pay yourself a consistent, reliable salary FIRST.

You simply can’t have a sustainable solo business if

you’re not getting paid for your work.

What if Spending Isn’t the Problem Preventing You From Paying Yourself?

Before we get into the nuts and bolts of talking about paying yourself, I want to acknowledge two reasons why many solo business owners aren’t paying themselves consistently. (It would be irresponsible for me not to address these as part of this discussion.)

Sometimes it’s a lack of clients that prevents you from paying yourself. In this case, there needs to be a proactive marketing plan put in place to get you in front of your target audience. I don’t want to belabor, but the reality is that you can’t sit and wait for clients to come to you. You need to be proactive about how you find clients.

If you’re proactively doing marketing and feel you don’t have the potential clients you need, consider whether your messaging, website, or offers are clear and compelling. Also, dig into each of your marketing activities to assess if it’s the right fit. For example, if you’re getting inquiries from Instagram but are all the wrong fit for your services, that may not be the right channel, and it’s time to switch things up.

While marketing takes time, activities that aren’t producing potential client leads aren’t sustainable. Remember, the 80/20 rule applies to your marketing efforts, that 80% of your outcomes will come from 20% of your activities. Figure out what 20% is driving results and go further. Adding more and more marketing is a recipe for wasted time and energy.

The other reason you may not be able to pay yourself comes down to your pricing. If you have a full client roster and need to make more money, something has to give. That’s unsustainable and only ramps up the resentment.

When I talk to service providers that want to burn down their business, it’s because they have a full client roster and still aren’t making enough money.

The global economy is a rollercoaster, which sometimes impacts business spending decisions. However, that doesn’t mean you can’t adjust your pricing, especially with new clients coming in the door.

Don’t make the mistake of deciding no one will pay your new rate, as there will always be clients willing to pay that rate. (Within reason of course!)

If you’re unsure about pricing, I recommend you use the salary goal we’re discussing to help you see clearly how you need to price your services.

As one of my mentors said, “We’re running a business, not a non-profit. You need to price things so we get paid appropriately.”

Setting Your Salary Goal

You didn’t start a business NOT to get paid. Or for you to pay everyone else instead or subsidize the costs of your services for your clients.

My goal is to help you pay yourself a professional salary so you can back into a revenue goal, your pricing and so much more.

You should consider your ideal “enough” number based on location to determine your salary goal.

As part of this exercise, I want you to consider how you can avoid being trapped in a cycle of conspicuous consumption and avoid exploiting anyone (including yourself) to reach that goal. In this essay, I share more details on this approach, including figuring out your enough so that you’re “balancing justice and liberation with being financially secure,” in the words of Bear Hebert.

Before we get into the math, I want to flag that I won’t tell you what that number should be. It will vary dramatically for each of you based on your unique situation. Still, I want to remind you that so many of the revenue goals in online business (looking at you six figures!) are arbitrary.

The above calculator will help you crunch the numbers to determine your desired salary goal. If anything isn’t applicable, you can input a zero.

Using the calculator, you need to include your expenses, such as:

- Coaching/courses

- Tools or tech

- Support services

- Travel

- Marketing

Please take the time to capture your expenses in full, as when we underestimate them; it impacts our ability to pay ourselves.

Of course, you want to account for your taxes, which you can do using the slider with the appropriate tax rate that applies to your business.

If you’re unsure what number to use for your taxes, I recommend you consult an accountant or bookkeeper to provide guidance. Most tax agencies have easy-to-find tax tables that outline your tax rate.

By working with the numbers, you can identify the best way to achieve your personal salary goal based on your specific situation and not the magical thinking prevalent in online business.

Four Common Questions About Paying Yourself

As always, I want to remind you that I’m not a money, tax, or accounting professional; this tool is a starting point. I’ve been running my own business for over 18 years, and I’ve been able to pay myself a healthy salary every single year.

I want you to be able to do the same by setting goals around your money, expenses, and salary that put you first.

#1. How and When Should I Pay Myself?

With that in mind, I often get asked how/when to pay yourself. The mechanics of this will largely depend on how your business is set up. You may need to put yourself on payroll or be in a situation where you can take draws from your business accounts.

Whether it's payroll or draws, please set a frequency on which you pay yourself, such as twice a month or biweekly. If you’re not doing that consistently, you may need to build up some cash in the business to start doing that.

I want to remind you that dealing with money can be loaded, so it's entirely normal if you’re having the feels about this. If need be, start small so you can consistently pay yourself, and then you can increase it over time as you feel more comfortable.

But trust me when I say this when you are paying yourself on a set schedule, you’ll feel more secure in your business as you see the results of your work in your personal bank account.

If you’re not separating your business and personal money, I 100% recommend you do that asap so you start to see the business money as its own bucket.

#2. Should I Use Personal Money to Pay For Things?

When you’re starting your business, you’re expected to need some startup funds from your personal bank account. Ideally, that should be a one-time event and treated as a “loan” that gets repaid.

I strongly recommend that you curb the urge to cash flow anything in your business with personal funds. It’s a slippery slope as we often don’t have access to capital in our business, but we have access to debt in our personal lives.

My motto has always been that the business needs to pay for its own expenses. There may be minor exceptions along the way, but using personal funds for the business can quickly create more significant issues beyond being able to pay yourself.

#3. How Much Should I Pay Myself?

This is a complex answer that I cannot tackle with a blanket answer, but what I can say is that you’re a professional service provider.

The exact number will vary based on your industry, role, experience, current business situation, and personal factors such as where you live. You should define this based on your specific needs, and remember it’s safe for you to be paid like a professional.

As so many service business owners I encounter have solid revenue in their business but continue to underpay themselves. They will keep cash in the company beyond what they could realistically need, which they could be paying themselves.

In the past, I’ve had clients look at what they would be paid for their corporate role, which has been an eye-opener. They can see how they’re not being greedy but rather that they should be paying themselves more.

And if you wish you could pay yourself more, but your revenue won’t support it, let this be something to encourage you that it is possible. Avoid comparing yourself to others, and know you may need some tweaks to achieve that desired salary goal.

#4. Should I Do Profit First?

Profit First is an accounting system that deducts profit from revenue before expenses. Honestly, I’m mixed on this for solo business owners, as while the principle is sound, it can often leave business owners in a situation where they’re unable to pay themselves.

I appreciate the idea of ensuring that your expenses are not at the cost of your profit or paying yourself, but as a solo business owner, profits are going to you at the end of the day, so it’s a bit of semantics.

If Profit First works for you and you can pay yourself a healthy and consistent salary, I would stick with it. However, even while your revenue is solid and you can’t pay yourself, you may need to revamp things if you're using it.

There’s a reason why I’m talking about salary as the first pillar of the Staying Solo Framework, and it’s because if you’re not getting paid appropriately, it’s hard to make solid business decisions. It’s challenging to show up every day and serve your clients.

While you may not be at your desired salary goal today, you have the power to make decisions quickly and take action. That may be reducing your expenses, doing more marketing to bring in more clients, fixing your pricing, or simply paying yourself in a more structured way.

By working the numbers, you can plan for what needs to happen so you are getting paid and your needs met. As I said off the top of the episode, no one starts a business not to make money, and I want to give you the know-how you need to create a solo business that’s sustainable for years to come.